It’s a phrase that almost all traders have heard at least once in their trading journey. Some might have experienced it and quit already, while others have overcome it, and some are probably thinking about quitting now. This post is for traders still struggling to find their path to consistent profitability and for winners trying to maximize their edge even further.

Trading is a field where the odds are stacked against you. It’s your job to choose the right instruments to trade, the right side of the trade, and the right strategy to execute at the right time if you want to stay afloat in the game. Getting so many things right can be difficult for a new trader.

Setting yourself up for success in trading is simply having a strategy or a system with a positive expectancy, in simpler terms, if you trade, you should make money over some time or over a certain number of trades. Some call this having an “edge” in the market.

What Is A Trading Edge?

What does having an “edge” in the market mean? What is an “edge”? An edge is simply having a well-defined, well-tested trading system or a strategy that tilts the scale even if just slightly - in your favor.

From the highest tier of trading - HFTs, institutional traders, etc., - their edge is simple - it’s the speed of execution and speed of information. We (retail traders) can never compete against them. Next tier of traders - small prop firms - their edge? Experience in the market and heavily backtested systems designed by the brightest quants in the field. They, too, are a tough bunch to compete against. Finally, we have retail traders with lots of money and who can read the market accurately purely based on decades of experience. At the bottom, we have new traders with barely any money and no experience.

So… now that we’ve clearly defined what an “edge” is and how far back of the race we are starting. What can we do to create an edge or find an edge of our own?

So… now that we’ve clearly defined what an “edge” is and how far back of the race we are starting. What can we do to create an edge or find an edge of our own?

How To Create An Edge

Let’s start simple: Say, you have just started and you have 10 trades under your belt where you traded based on some simple strategy you derived or learned from.

What’s next? Improve the strategy? - How?

If you are losing money, is it the strategy’s fault? Or your fault? - How to determine this?

Based on the above questions, how can you find your “edge”? The answer to all of these questions is quite simple. In fact, we bet most of you have already done this in a different context many times. Remember studying for tests in university & school? If you did badly on a test, would you simply throw away your answers and go in blindly to the next exam? Or did you analyze your answers, find faults, and re-studied the material in which you thought you were weak?

The same concept applies to trading. But a very small number of traders understand this. Here’s a PnL curve of a real trading account for 60 days:

Looking at the graph above, one may wonder, what happened? Why was the performance so inconsistent? Were the initial gains just due to luck? Perhaps favorable and easy market conditions? The answer is simple: this is simply a system with no trading edge.

What’s next? Improve the strategy? - How?

If you are losing money, is it the strategy’s fault? Or your fault? - How to determine this?

Based on the above questions, how can you find your “edge”? The answer to all of these questions is quite simple. In fact, we bet most of you have already done this in a different context many times. Remember studying for tests in university & school? If you did badly on a test, would you simply throw away your answers and go in blindly to the next exam? Or did you analyze your answers, find faults, and re-studied the material in which you thought you were weak?

The same concept applies to trading. But a very small number of traders understand this. Here’s a PnL curve of a real trading account for 60 days:

Always remember: Unless you have a solid, well-tested trading system, no matter how much earn in good market conditions or at the beginning of your trading journal, it’s not a question of “if” you will blow up your account - rather, it’s a question of “WHEN” you will blow up your trading account. Just like in the example above.

How do you go about finding your trading edge in the mess above? The answer, once again, is very simple: use a trading journal or spreadsheet that has enough features to help you figure out all the good and bad parts of your trading.

Here are some of the biggest losing trades the trader in question incurred from the PnL graph above:

How would you go about filtering the good from the bad, other than just the PnL?

There could be a million reasons why you lose a trade. But the real question is, how do you stop making those losing trades?

Here is the analysis you need to do to figure out why you keep losing:

Who would’ve thought this person absolutely would have lost so much money just trading above the $10 price range? The steps to follow here are to break down why the trader is losing in this range, or simply just avoid this range for now and re-evaluate in the future.

Here’s how the chart would’ve looked like if we removed those trades:

There could be a million reasons why you lose a trade. But the real question is, how do you stop making those losing trades?

Here is the analysis you need to do to figure out why you keep losing:

- What times are you best at trading? Market open? Market closed?

- What size do you feel comfortable trading with?

- What asset types are you good at? Options? Stocks? Futures?

- Are you good at swing trades? Or short intraday scalps?

- Going long? Going short? What’s your winning percentage for these trades?

- Do the market conditions (like RSI/ATR of popular indices) affect your win rate?

Sounds complex? It’s not. Analyzing your trades and system can be done via hand or various software out there. This article will walk you through how to do this. To make this as easy as possible, we will use TradesViz.com, a free trading journal software.

Optimizing Your Stock Trading Edge

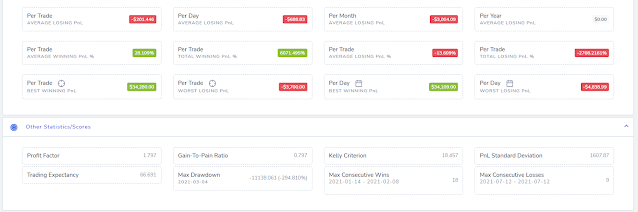

Using TradesViz, after importing your trades, it will break down your system in an easy-to-understand manner, as shown in the picture below.As shown in the picture above, TradesViz pointed out that 87% of the trading system losses were a result of trading stocks within the range of $10-$21.

Here’s how the chart would’ve looked like if we removed those trades:

Here’s another example:

Premarket trading is another aspect where this trader is losing money. This money leak can apply to a lot of traders who try to get in before the news/market-open-based price changes, but this is often very risky (as pre- and post-market are easily manipulated to sucker in retail traders).

With just two removals of trading behavior—i.e., trading > $10 and trading in pre/after hours—we’ve made massive improvements to our system. Now, it’s time for forward testing, where you strictly follow these rules and compare your performance before and after. Once again, this can be done with the strategy compare tool.

Stock Trading Metrics

One of the important statistics you need to keep track of is, what is your average profit factor.We only explored how 2 very simple trade-based properties - i.e., trade time and trade price affected your overall performance. TradesViz has identified 50+ other attributes to analyze a trading system, which is used to optimize trading systems. Their blog breaks down the various visualization tools they use to identify leaks in your trading system. It's a good starting point for those serious about trading.

Here’s another example with visualization using a histogram chart:

These charts give us an easy-to-understand analysis of our trades. A quick glance tells us this trader is bleeding money and trading tech stocks. Losing via trading tech stock is very common, as tech stocks are at the forefront of FOMO. Especially during earnings times, options of these stocks become very risky to trade. But there would be 10 other reasons why the performance is bad.

How to find that? You can add filters to your spreadsheet/journal, where you simply filter the stocks by the tech sector and repeat the analysis we did previously! TradesViz Blog breaks down many types of useful filtering, which can be used to continually find leaks and edges in your system.

We just found that the low-price range stocks that this trader did not perform well in are pretty much ALL tech stocks

Like this, simply refining what you have, focusing on the good parts of your system, and learning how to avoid large losses can itself be a trading edge for you. This is done by simply taking the time and analyze your system and not blindly following other Traders on Social Media or on Reddit.

Conclusion

As we showed, once you have identified your flaws, all that is left to do is be disciplined and strictly follow the rules you put in place. This is the hardest part of trading. You might find an edge with complex analysis and backtesting, but the execution of your trading system/edge is purely done by you, so with your dedication and effort to adhere to the rules of your system, you are inevitably going to fail. However, if you do pull this off and are used to this cycle of analysis -> testing -> putting it into practice, you’ve just gained a skill to consistently make money for the rest of your life.

For those who want to actually want to create a trading system, please follow the tutorial shown: How To Create A Trading System. If you are interested in improving your overall trading skills, be sure to check out our recommended books for stock trading.