As I have talked about countless times on here, having an edge in the market directly correlates to having something unique that is not public, that no one else uses. It's always about thinking outside the box and doing things differently enough to give you that trading edge over everyone else. In this article, we will discuss how a trader just did that, thinking outside the box, made things a bit different than before, and used this new strategy to become profitable.

EMA Clouds is one of the newest and most effective indicators, recently developed and pioneered by Ripster. The EMA Cloud System takes two desired EMAs. The area in between is shaded to visually represent the trend direction and determines the support and resistance levels. Refer to the EMA Cloud Chart above, using a real-life example of $SPY.

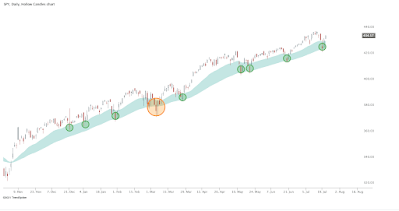

Notice how the 20 EMA is above the 50 EMA; this yields a green (bullish cloud), which then provides support for the price as it falls through the cloud. In this case, the price will likely bounce off the cloud and continue higher, exactly what happened.

For those astute traders, you will notice that the EMA Clouds are very similar to the Ichimoku Cloud System. What Ripster did was inspired by Ichimoku Clouds, utilized his own critical thinking, and innovated.

How to use the EMA Cloud Indicator

The idea behind the indicator is that the EMA cloud area represents support/resistance. This system can be profitably applied to any time frame (day trading, swing trading, etc.). It's a momentum indicator that predicts when prices will bounce.Many different combinations can be applied via the Cloud system. Determining what works best for you and your style is crucial. EMA Settings of 5-12, 34-50, 8-9, and 20-22 are typically used. The first number represents one EMA, and the second part will be a higher number representing the second EMA. The shaded region between the two becomes the cloud. I suggest tinkering with these settings and seeing what else is out there.

According to Ripster, the ideal combination that creates a fluid trendline for day trades is a 5-12 or 5-13 EMA cloud, while the pullback levels can be identified using an 8-9 EMA cloud.

A bullish/bearish trend is confirmed when the price is over/under 34-50 EMA clouds for any set timeframe.

Here you can see where the 34 EMA is below the 50 EMA (34-50 setting), it's portrayed as a red cloud, and the cloud starts to act as resistance.

Ideally, your setup will include many EMA clouds on your chart, where the 34/50 EMA will be your long-term trend direction, and the other smaller clouds will be your bounce, add, and sell targets. So your chart will essentially look like a rainbow EMA cloud, see below:

Step by Step guide on using EMA Cloud

- Look for the indicator on your preferred trading system, such as TrendSpider (click the link for 40% off!). Be warned that, as new as this indicator is, it will only appear on a few platforms. Make sure to Google to confirm. It's only on TrendSpider and TradingView (the script for EMA Cloud is linked).

- Add your preferred set of moving average types; the commonly used being the exponential moving average. One long-term (i.e., 34-50) and the other short-term (i.e., 8-9). (If using TrendSpider, it is recommended you use the backtesting tool to find what EMA settings are most profitable.)

- Much like Ichimoku Clouds, you can set the Cloud forward and backward in time using the Offset entry. The setting of zero will keep the EMAs current with respect to price, but values such as 5 will move the Cloud (forward). Again, it is important to tweak these settings and see if you can make things more profitable. Some prefer having an offset to move the Cloud from previous days further/backward, as they think it may give better accuracy. This is something you will want to test.

Chart Interpretation

When the short-period EMA graph line goes above the long-term EMA trend line (thus turning green), this is a bullish signal, while vice versa when the market is bearish.So note at inflection points where a red cloud turns green, and vice versa! These are buying & selling signals. However, be careful being whipsawed, make sure the settings you have can withstand false signals where the cloud turns colors too easily, giving you bad signals.

Here is another example of how SPY continually bounces off the cloud over time. Note this is a daily chart of the 20/50 EMAs:

Here is another example of how SPY continually bounces off the cloud over time. Note this is a daily chart of the 20/50 EMAs:

Additionally, check out the chart below straight from Ripster47's Twitter account, where he gives an example with annotations with the EMA Cloud using a one-minute chart with Apple ($AAPL). He's using the 34/50 EMA Cloud, where the stock turned from bearish to bullish, followed by a nice bounce, where following the cloud would have made all aspects of the trade profitable:

Conclusion

The EMA Cloud is one of those rare indicators that come out, which has a fresh take on stagnant technical indicators that have been out there for decades. It is strongly advised that traders pay attention to this indicator and backtest it to see its strengths and weaknesses. Sign up for TrendSpider (use the link for 40% off) and test it with their backtesting tool. Make sure to tweak the settings and see how to improve it.

Also, add indicators to develop a cluster of signals, and see how you can make this more profitable and uniquely your own.

For those still struggling to gain that elusive stock trading edge, check out our step-by-step guide on creating one. Additionally, I have provided a step-by-step tutorial on creating a stock trading system for those who want to use TrendSpider.

Finally, check out our EMA vs. SMA indicator article for serious, eager-to-learn traders who want to know more about EMAs as they are used in EMA Clouds.

For those interested in using TrendSpider, make sure to check out my affiliate link for 40% off! I strongly recommend signing up for the Enhanced package, which comes with free weekly one-on-one training sessions via their customer service!

Also, are you looking for more innovative indicators? Check out our article on RainDrop Charts, which incorporates volume into chart reading to help avoid fake breakouts.

Also, are you looking for more innovative indicators? Check out our article on RainDrop Charts, which incorporates volume into chart reading to help avoid fake breakouts.