This trading system combines two indicators: a 13-day exponential moving average and the MACD Histogram. The 13-day exponential moving average identifies the trend of the price movement, while the momentum is measured by the MACD histogram. When these two indicators are combined, a trader can easily identify tradable impulses (buy and sell entries).

How to use this indicator in trading

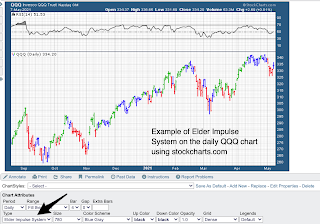

The ease of use in this trading system comes from the color-coded price bars indicator, as shown in the chart above ( please study it as it’s pretty self-explanatory).- A green price bar will be indicated when the 13-period EMA is greater than the previous 13-period EMA and the MACD Histogram is greater than the previous period’s MACD –Histogram. This is the indication to go long/buy.

- A red price bar indicates that the 13-period EMA is less than the previous 13-period EMA and the MACD-Histogram is less than the previous period MACD-Histogram. This is your sell signal, or entry point to go short.

- A blue price bar indicates that the conditions for a green or a red price bar have not been met. This is the neutral state. Depending on your system you can either decide to continue to hold long, short, or simply exit if trading options.

When to Exit & Enter The Market

When the long-term trend is green meaning that the prices are going up, and the Elder Impulse System is also green then this is a buy signal. For example, let's say that your intermediate trading period is daily you have to check if your weekly chart indicates a uniform uptrend as well.When the long-term trend turns bearish, that is, the prices have started moving downwards and the Elder Impulse System turns bearish then this indicates a Sell signal.

When the long-term trend is not clear if it is an upward or a downward trend then the signal is ignored.

Conclusion

The Elder Impulse trading system has been designed to identify small price movements. Elder explains in his book that the system has been designed to encourage you to enter into a trade carefully and exit fast which is the professional trading approach, unlike the amateurs who will enter into a trade quickly and take a long time to exit with no stops, hoping that the trend will go their way.I encourage readers to use a website like StockCharts to paper trade and run tests on the Elder Pulse System. It is a great start for a trading system, which can easily be refined and tweaked through practice and backtesting to become profitable. If you want to beat the Market, trading the Elder Impulse system is a great first step. See the example below on how to use StockCharts with the Elder Impulse System.

I hope this guide has been an eye-opener to anyone who wants to start using an actual trading system. Check out my other articles on other indicators the ADX and RSI that can help you make money. Also, if interested in more trading systems, check out my guide to Using Ichimoku Clouds For Daytrading.